Transparency

Focused on supply for finance, this pillar of activities monitors financial institutions' sustainability practices such as net-zero commitments.

We conduct robust and data-driven research based on strong expertise in climate finance analysis. We contribute to improving science-based methodologies and reliable and transparent frameworks at international level.

Transparency and accountability are essential to ensure the financial sector contributes positively to the sustainable transition of the real economy. Improving the regulatory framework is essential to ensure consistency and credibility in sustainability disclosures.

Since the Paris Financial Center statement and launch of the Observatory

Since the Paris Financial Center statement and launch of the Observatory

,,k,kk,kk,k,,kk,k,k

Through the Net Zero Donut methodology

Through the Net Zero Donut methodology

SFDR / Art. 29 LEC regulatory reports collected and analysed with ADEME

SFDR / Art. 29 LEC regulatory reports collected and analysed with ADEME

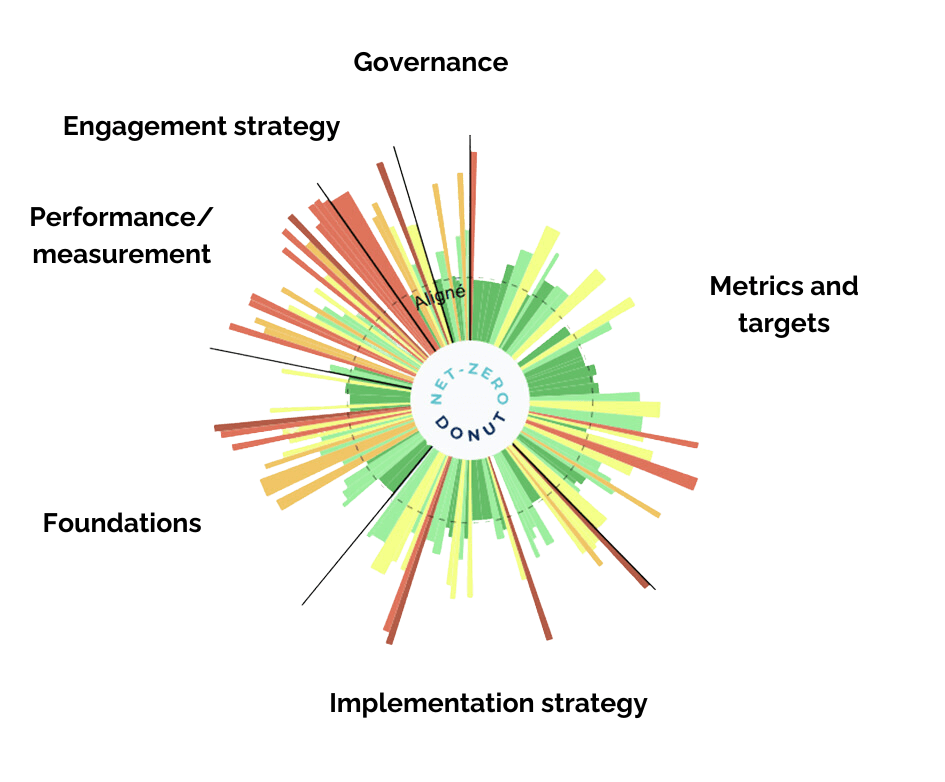

Focus on the Net Zero Donut

The Net Zero Donut® is a tool designed by the Sustainable Finance Observatory to monitor and assess the credibility and ambition of net-zero commitment implementation by financial institutions. It includes four components: (a) an exclusive framework assessed by PARC’s Scientific and Expertise Committee; (b) an online interactive data visualization tool; (c) a dataset of currently 60+ financial institutions including 220+ indicators; and (d) annual analysis reports based on this data. It is co-funded by ADEME and led by the Sustainable Finance Observatory with the voluntary contribution of our members and PARC’s Scientific and Expertise Committee.

Deep dive into the Net Zero Donut

Focus on the Climate Transparency Hub

Since the French Energy and Climate Law and the 2021 decree implementing Article 29, French investors have been required to publish annually, through what is known as ‘Article 29 LEC’, a report describing their practices for taking into account sustainability aspects (environmental, climate and biodiversity, social and governance criteria) in their investment activities. To give these reports greater visibility and facilitate their analysis, the law entrusts ADEME with the task of collecting and publishing these reports in a centralized manner on a publicly accessible website: the Climate Transparency Hub (CTH). ADEME, with the support of the Sustainable Finance Observatory, carries out an annual analysis of these reports, to identify statistical trends in reporting and improve financial institution reporting practices. Until 2024, this analysis was carried out with the contribution of the LIFE Finance ClimAct program.

Read more about the Climate Transparency Hub

Focus on the ADEME-Sustainable Finance Observatory partnership

The ADEME-Sustainable Finance Observatory partnership is the core program of our Transparency pillar.

Read more about ADEME-Sustainable Finance Observatory partnership

Latest Publication:

Publications • October 3, 2025

What the NZBA leaves behind

Today October 3rd 2025 the NZBA announced its end. This marks a major setback in the mobilisation of the financial sector for climate action. Last January, the GFANZ made significant changes in its strategic positioning. What legacy does the NZBA leave behind? What remains of banks’ net zero interim targets? What future for private finance contribution to the transition?