Retail investing

There is a major market failure between EU retail investors investment preferences and the fact that only a small share actually hold impact generating financial products. Since 2017, the Sustainable Finance Observatory has been a leading authority shaping EU retail sustainable finance through research, policy engagement, product innovation (e.g. MyFairMoney) and large-scale communication.

The opportunity

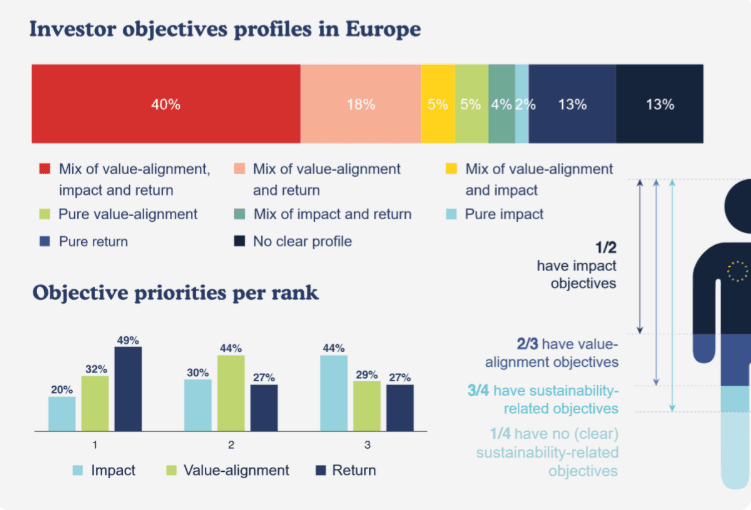

EU savers hold 1/3 of all European financial assets and represent one of the largest untapped sources of capital for the sustainable transition. The good news is interest in sustainable financial products continues to grow rapidly and 51% of EU retail investors seek investments that make a real-world difference. Mobilizing this demand through saving accounts, investment funds and pension or life insurance is one of the EU’s most powerful levers for reorienting finance towards sustainability. Yet, the system designed to match retail investor preferences with sustainable investments is not functioning as intended.

In its next phase, SFO aims to mobilize EU household savings for the transition, strengthen consumer protection, close supply–demand gaps, and guide key reforms such as SFDR, MiFID/IDD, IORPs and retail investment rules.

The problem

Despite major EU reforms (including SFDR, MiFID II and IDD), our research shows:

Retail investor demand: strong but untapped

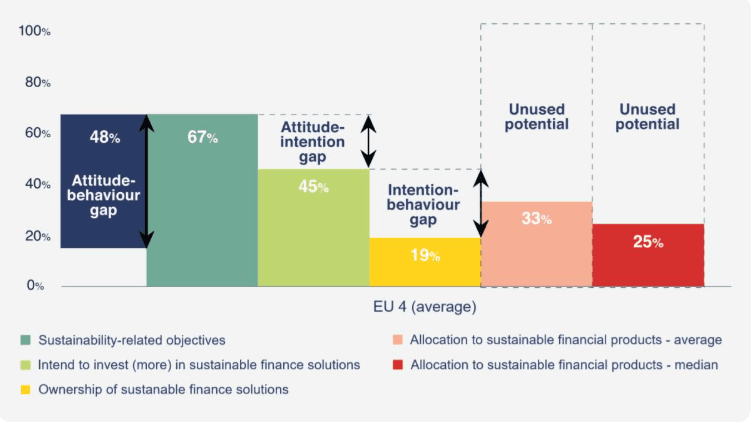

- 74% of EU retail investors have sustainability-related objectives (i.e. value alignment and/or impact), yet in key markets only 19% hold sustainable financial products, revealing a significant attitude-behavior gap.

- Despite increased average allocations towards sustainable products post-regulation, we expect that a multi-trillion EUR market remains untapped.

- Key barriers preventing retail investors from walking their talk include limited expertise, high information costs, and a lack of trust in the credibility of sustainable financial products.

A deficient advisory process

- In 57% of financial advice meetings (2022–2024), sustainability preferences were not automatically assessed.

- In 54% of German cases, advisors altered client preferences while in 53% of French cases, unsubstantiated impact claims were made.

- Advisor knowledge has improved overall but remains weak on investor impact across Member States.

Structural misallocation of impact-oriented capital

- 51% of EU retail investors want to generate real-world impact with their savings, but impact products make up only 0.7–1.3% of the market in key countries such as Germany and Austria.

- A majority of impact-oriented investors are willing to pay for real-world impact but mistakenly believe that low-carbon funds directly reduce emissions, making them vulnerable to misleading claims and potential exploitation.

- 27% of 450 Art. 8 and 9 funds reviewed in 2023 made explicit environmental impact claims — none substantiated, while 76% of investors expected real impact from such claims.

Regulatory and conceptual gaps

- The definitions of ‘sustainability preferences’ or ‘sustainable investments’ exclude impact-generating investments, misaligning with 51% of investor objectives.

- MiFID II and SFDR lack definitions for sustainability-related objectives, leading to inconsistent classification and advice.

- Oversight and enforcement remain inadequate across the EU, allowing persistent compliance failures and greenwashing risks

This undermines trust, slows the EU’s sustainable finance agenda, and prevents billions of euros from flowing to activities that support climate and environmental goals.

Our track record

Since 2017 SFO has led one of the largest retail sustainable finance research programs in the EU, analyzing demand, distribution and supply across 14 Member States. Our work has directly shaped the EU retail sustainable finance framework:

- Research: Quantitative and qualitative research on sustainability preferences of retail investors (covering 14 EU countries), surveillance of financial advisor practices (covering 15 EU countries), fund impact claim assessments across Europe.

- Policy: Influencing the Commission’s SFDR proposal on the integration of impact into new product categories, contributing to the Platform on Sustainable Finance 2.0, participating in consultation processes and working groups on sustainable finance such as EU Ecolabel, MiFID II/IDD, SFDR and PRIIPS.

- Product development: Development of the largest public platform for EU retail on sustainable finance (www.myfairmoney.eu), AI chatbot on sustainable finance, supporting robot advisor developments.

- Communication: Conferences, events and roadshows across Europe, mass campaign on traditional and social media, sustainable finance documentary, sustainable finance podcast.

We are a trusted source of insight for EU policymakers, supervisors, market participants and civil society – widely recognized for critical oversight of the retail sustainable finance ecosystem.

Our next phase

To ensure that retail investment genuinely supports the EU’s sustainability goals, we will:

- Mobilize EU savings to finance the sustainable transition through sustainable saving accounts, investment funds and pension or life insurances.

- Analyse and help address the supply-demand gaps in sustainable and impact-oriented financial products.

- Produce evidence to guide EU policymakers and supervisors during SFDR, MiFID/IDD, IORPs, SRD II and retail investment reforms.

- Advance consumer protection and safeguard an independent civil-society oversight function within the EU ecosystem.