Commitments Monitoring

We have built a strong expertise on tracking and evaluating sustainability commitments and practices of financial institutions.

Between 2019 and 2024, the Observatoire de la Finance Durable was missionned by French Economy and Finance Minister and Paris financial center to monitor the ESG commitments of French financial institutions and to disclose the agregated exposure to fossil fuels of Paris financial center - this mission has been taken over by the Institut de la Finance Durable.

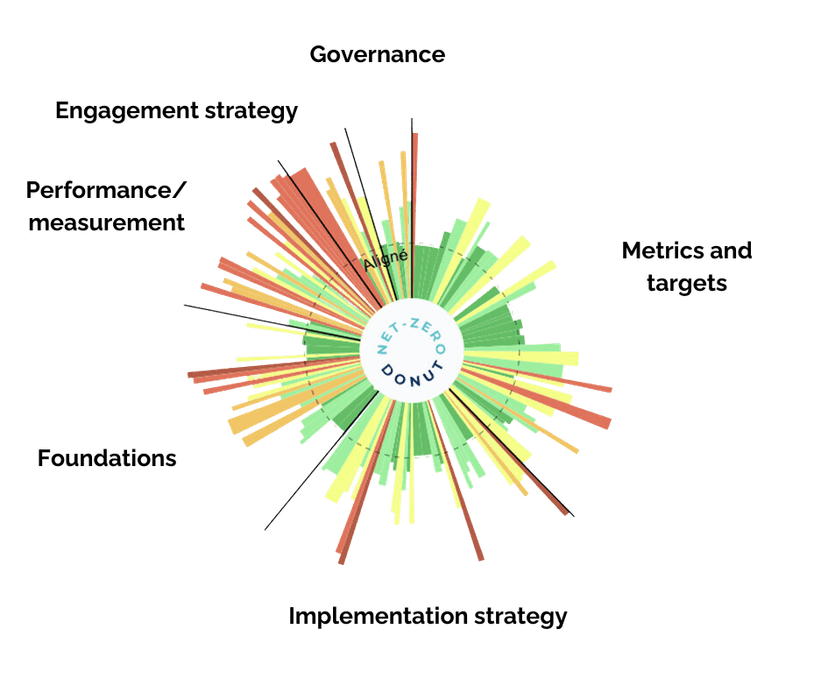

Our activity of commitments follow-up has been continued throughout the Net Zero Donut, a methodology and tool for the assessment of net zero commitments. We also work closely with ADEME using ACT Finance, the most comprehensive methodology of evaluation of transition plans for the financial sector. At this day, those analyses have been conducted at at the French level, based on regulatory disclosures of asset managers and owners under the 'Article 29 LEC' regulatory framework that are collected and analysed on the Climate Transparency Hub.

French Finance and Economy Minister Bruno Le Maire in 2019, during the reunion of Paris financial center:

Lastest Publication:

Publications • October 3, 2025

What the NZBA leaves behind

Today October 3rd 2025 the NZBA announced its end. This marks a major setback in the mobilisation of the financial sector for climate action. Last January, the GFANZ made significant changes in its strategic positioning. What legacy does the NZBA leave behind? What remains of banks’ net zero interim targets? What future for private finance contribution to the transition?